It’s estimated that over 90% of residential home purchases in Mexico are not transacted using borrowed money.

However, financing options for Mexican property is increasing through mortgages offered by Mexico’s principal banks, and some specialized lenders also offer so-called “cross-border” loans—lending money in US dollars, at dollar rates, for the purpose of buying property in Mexico.

This article outlines some key points to note as you consider financing a residential property in Mexico—including an outline of the principal options buyers may examine as a means to finance their home here.

Principal ways to finance a residential property purchase in Mexico

The main routes by which foreign nationals tend to finance the purchase of a residential home in Mexico are:

- Cash purchase.

- Developer financing.

- Seller financing.

- Mexican bank mortgage.

- Specialized lender mortgage (‘cross-border’ loan).

- Specialist financing.

Cash purchase

The overwhelming number of property transactions in Mexico (estimated at higher than 90%) are transacted on a cash basis.

Sellers either have the cash in the bank or sell investments elsewhere (a house or other investment asset) to create liquid capital to transact the property purchase in Mexico.

“Cash buyers” have the advantage of being able to move swiftly and might also be able to negotiate lower prices if competing buyers don’t have ready cash, need to sell their home, or need to get approval for loans before they can commit to buy.

If the property is being sold on agrarian terms, i.e. possession, not legal title, then the transaction must be made with cash, seller financing, or other private financing as commercial banks will not mortgage these property types.

Developer financing

If you are buying a brand-new home from a real estate developer, the developer might offer staged payments, and some property developers also offer financing—although interest rates on their loans might be higher than rates offered by US banks. Check the details of the interest rates as well as other terms of those loans.

Whether staged payments are offered —paying for the property using several smaller payments over a defined period that is also often tied to specific events in a property’s construction cycle— depends on whether the property is bought ‘off-plan’ (i.e., the construction has not started), whether construction is ongoing, or whether the property is ready to move into.

Seller financing

In some cases, the seller of the property (even a private property) might be willing to accept staged payments from the buyer over months, or years.

Each arrangement is custom-made, and any agreements should be made formally with the professional assistance of a Notary Public, who will draw a up a legal contract that sets out the formal arrangement between the parties.

Typically, the property is placed into a trust in the seller’s name and when the buyer has discharged all payments owing, the trust is transferred into the name of the buyer.

Sellers ought to be aware that evicting a person from a property in Mexico is time consuming and will carry legal costs in the event that the buyer breaks the terms of the arrangement.

Mortgage from a Mexican bank

Mexican banks offer mortgages although interest rates may be higher than you are accustomed to. Substantial deposits are also required, and the ‘loan-to-value ratio’ —the sum the bank is willing to lend in relation to the house price— will vary depending on your circumstances as well as current house market sentiment.

Loan to Value (LTV) ratio when financing a home in Mexico

Foreign residents in Mexico who qualify for a loan are typically offered up to 90% of the property’s agreed sale value, thus requiring a 10% deposit from the borrower.

However in some cases, the bank or specialist lender might offer just 60% or less of the property’s market value, as assessed by the bank, as a loan amount.

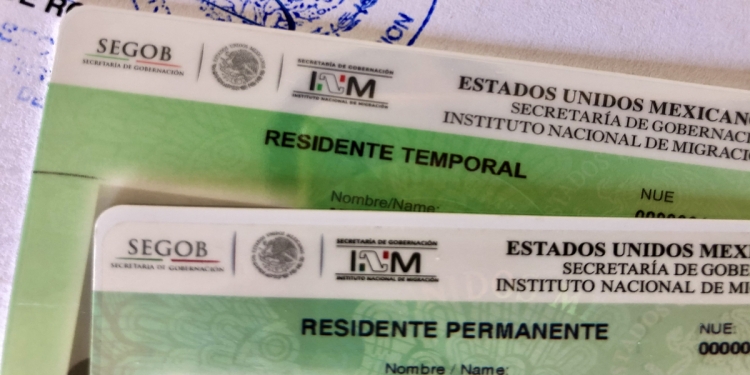

Most commercial banks in Mexico will only lend money to foreign nationals with Residente Permanente status; foreign nationals with Residente Temporal status cannot usually acquire credit in Mexico.

Permanent residents who apply for mortgage credit may be asked to furnish some or all of the following documents to obtain credit in Mexico:

- A bank account history showing regular inward payments to the account; this could be a Mexican bank account, or a foreign bank account.

- A Mexican tax number (RFC);

- Recent bank statements from a bank abroad; and/or recent credit card statements;

- Medical certificate that verifies the good health of the mortgagee (for life assurance on mortgages).

- Credit reference letter from banks of financial institutions based abroad.

Specialized lender mortgage, or ‘Cross Border Mortgages’

Most of Mexico’s largest commercial banks are subsidiaries of large multi-nationals and/or have certain affiliations with foreign banks.

Some banks have started offering, through U.S. and Canadian affiliates, so-called ‘Cross Border Mortgages’ for Mexican real estate: lending money in dollars to U.S. and Canadian residents to buy property in Mexico—typically secured on the buyer’s foreign income, most usually a pension. This type of financing is also being offered by several independent specialist mortgage companies.

Typical characteristics of specialized ‘cross border’ loans:

- The maturities and rates offered vary from bank to bank.

- Loans are available from three years to 30 years.

- Rates on dollar-denominated loans are lower than those on peso-denominated loans, but higher than rates offered on mortgages for property situated in the U.S. or Canada.

- Some of these mortgages are fixed rate, and others are linked to interbank benchmark rates—plus a premium.

- These ‘cross border’ loans typically require a minimum loan amount of US$100,000 and will typically be for a maximum 70% of the value of the property being bought, so buyers need to raise substantial deposits for these types of mortgages.

Charges and paperwork requirements for these loans are comparable to those for obtaining loans in Mexico, for example:

- They require minimum credit scores.

- The borrower must take on and keep current mortgage life insurance, and property damage insurance.

- The lender will ask to see official identification, proof of income, copies of tax returns, and recent bank statements.

- You will need to show detailed documentation that proves the current legal status of the property in Mexico—you cannot finance property in Mexico sold on agrarian terms.

- These specialized loans also carry fees for extending the credit, charges for credit scoring, and fees for formal property valuation.

Specialized financing options for Mexican property

A range of specialized financing options may be available depending on your circumstances. These include:

- Using your retirement savings (401k) to finance property in Mexico.

- Taking out a ‘home equity’ loan on an existing property you own outside of Mexico and using the capital to buy property in Mexico.

- Taking out a personal loan abroad and using the money to buy a home in Mexico.

- Setting up a special type of trust that is placed into the lender’s name until the payments are completed, at which time the lender discharges their benefit from the trust and passes it to the buyer.

- Other finance options might also be available, depending on your circumstances.

We recommend that you seek the advice of a certified financial advisor if you want to consider any of these financing routes to buy a home in Mexico.

Earning in dollars or euros, and borrowing in pesos?

When you earn in one currency and borrow in another you are taking on an exchange rate risk—a type of gamble that carries the potential to reduce or increase the overall cost of the financing arrangement over the period of the loan.

As we have mentioned elsewhere in these pages, the value of Mexico’s currency fluctuates daily, and predicting exchange rates is a mug’s game. If you earn (or have investment or retirement income in another currency), and choose to take out a loan denominated in Mexican pesos, keep these points in mind:

Terms: You are locking yourself into rates and loan terms related to the Mexican finance market and the peso.

Exchange rates: If the peso devalues against your income currency you will pay less (dollars) for your loan, but if it appreciates in relation to it, you will pay more—in the addition to the higher interest rates that are charged for peso loans.

Foreign exchange rate fees: You will need to sell units of your foreign currency to buy pesos to service your loan—and the foreign exchange rate fees amount to an additional cost of financing.

If you’re considering this type of arrangement, we recommend you talk to a financial adviser first, who will be able to give you a detailed appraisal of the risks and options related to doing this.

Fees, charges, and background checks

As with most financial loan products, there is an assortment of charges levied on the borrower as well as a pile of documents to file for a credit application to be considered and funds to be approved, and released for use.

Fees and charges for property loans in Mexico

Common charges to open a mortgage account include:

- Mortgage assessment and arrangement fees.

- Credit referencing fees.

- Formal property valuation fees.

- Insurance fees, including life insurance and property insurance.

- Other legal and professional fees.

- Also note that some mortgages may carry an early repayment penalty fee. Not all do; check the terms of the loan agreement for details about this.

Background checks (documentation)

Before financiers lend you any money, they conduct extensive investigations of their potential clients, including proof of income, checking the credit bureau for your credit history reports (in Mexico and abroad), as well as socio-economic studies to assess the risk of the loan.

Common requirements include:

- A minimum age, usually 18 but it depends on the bank; and not older than 70.

- Legal residency status: Mexican banks will usually require Permanent Residency status to extend any loan, secured or unsecured; specialized lenders might not require you to be resident, and/or might accept Temporary Residents.

- Proof of income (dual incomes can be considered for couples).

- Bank references and recent bank statements.

- Official identification and proof of address.

- Birth certificate, and marriage certificate if applicable. These might need to be apostilled and translated into Spanish.

Additionally, you’ll need to show documents related to the property transaction such as:

- The formal signed contract between the buyer and the seller.

- Proof of any deposits or forward payments made to the seller.

- Copy of the legal title deeds for the property.

- If the loan is for construction, you’ll need to show the deeds and official map of the land parcel as well a copy of the architectural plans, and official permissions to build, as relevant.

- Copies of receipts for property taxes and other utilities to show that the property has no liens of this type.

- Foreign residents may be asked for a foreign national acquisition permit, and lenders will want to see this granted before they release any funds.

Time scales for arranging finance on a property in Mexico

Banks and other specialized lenders have been improving the ‘turn-around’ time for loan approvals in recent years. Some will give a decision ‘in principle’ (subject to further investigation) within a few days and may release the funds within a couple of weeks. The process can take much longer, though, so you should be prepared for this.

It’s unwise to commit yourself to a non-negotiable or time-limited contract to buy a property based on a loan given ‘in principle’ as the lender may take longer than you expect to complete the necessary checks and can even refuse the loan at the last minute.

Even when the loan is agreed, it may take several weeks for the lender to release the funds. Keep your plans and intentions flexible and don’t commit to any contractual agreements before the funds have been released by the lender.

Learn more about property in Mexico

Mexperience offers detailed insights about property in Mexico for buyers, owners, renters, and sellers.

- Latest articles and insights about real estate in Mexico

- The costs and taxes of buying a home in Mexico

- The costs and taxes of selling a home in Mexico

- Shared ownership of property in Mexico

- The Mexican peso and exchange rates

- Insuring your Mexican home

- Enjoying your home and home life in Mexico

Mexico in your inbox

Our free newsletter about Mexico brings you a monthly round-up of recently published stories and opportunities, as well as gems from our archives.